Accept payments with one

powerful solution

popular payment methods—while seamlessly running your business from your Nex dashboard.

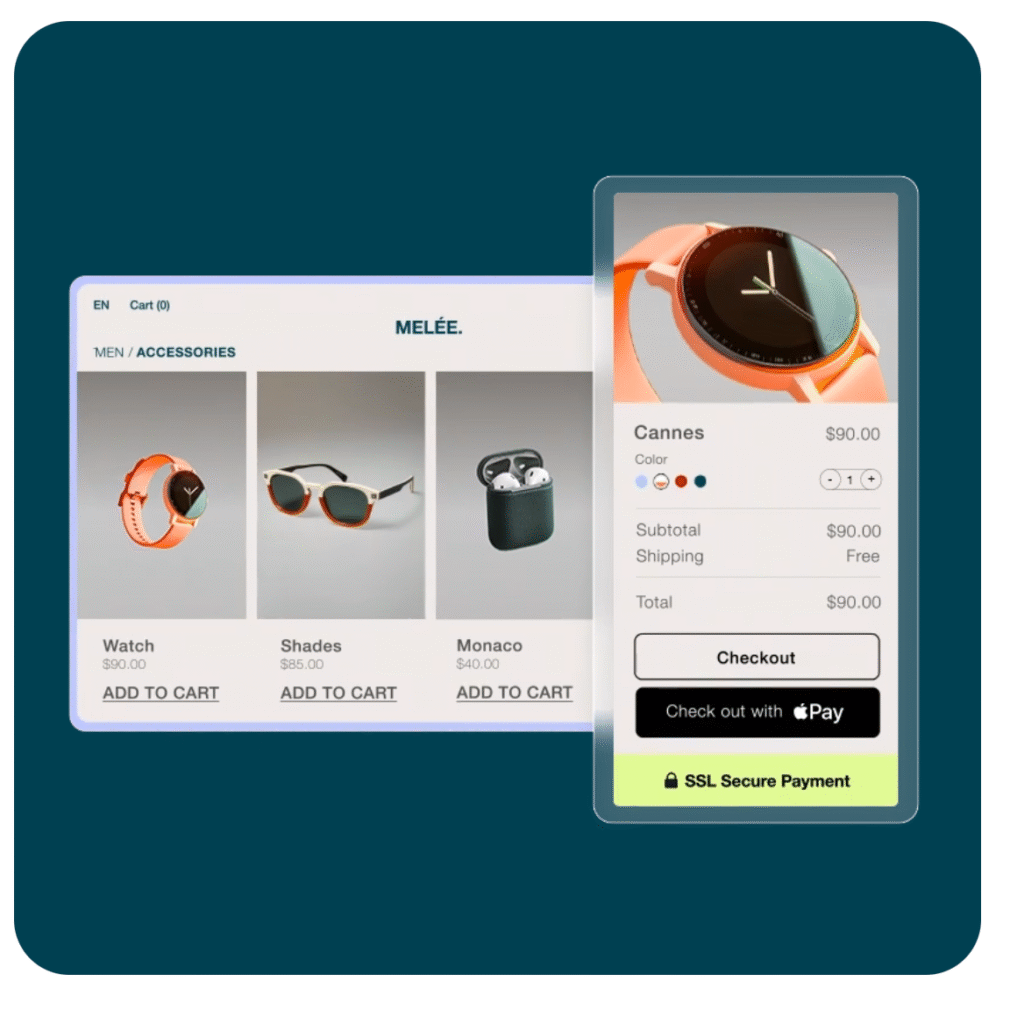

Let your customers

choose how they pay

Offer a suite of convenient payment options on your website. Make purchasing easier for your customers.

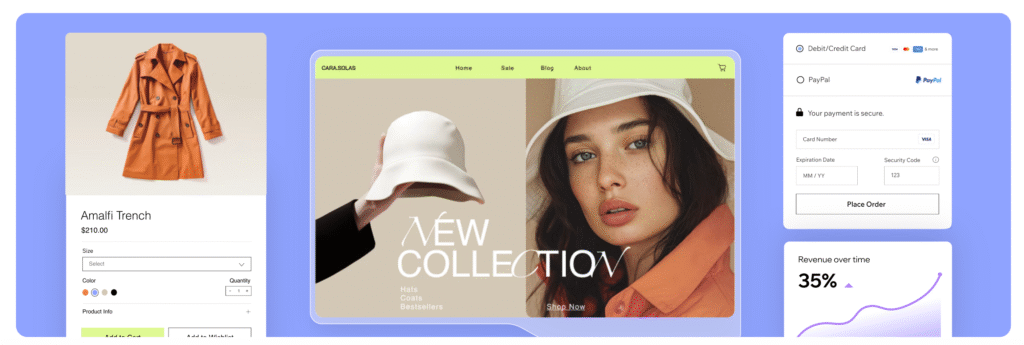

Multiple payment methods

Accept payments online—or in person with Nex POS—from major debit/credit cards, Apple Pay, Google Pay, PayPal, Tap to Pay, local currencies, BNPLs like Affirm, Afterpay, Klarna, and more.

Optimized checkout

Help boost conversions with a full suite of payment options on your eCommerce website. Help reduce abandoned carts with a checkout customized to suit your customers.

Nex Point of Sale (POS)

Get paid wherever you sell—online and in person. Manage your inventory, sales, payments, analytics and more with Nex POS. Currently, Nex POS is available to Nex Merchants based in the U.S., Canada and U.K. (except Northern Ireland).

Flexible payment options

Build customer loyalty and earn revenue by offering flexible payments. Let customers pay as they go or purchase memberships, subscriptions and packages.

Manage your business

on one platform

Accept payments by connecting our own payment provider Nex Payments or choose from 80+ payment providers.

All-in-one business solution

Streamline your business with Nex Payments. Manage everything from your dashboard—from payments to orders, bookings, events, services, classes, subscriptions and more.

Competitive processing fees

Get fixed payment processing fees based on your business’ transactions. With transparent pricing, you get one fixed fee for credit card processing online.

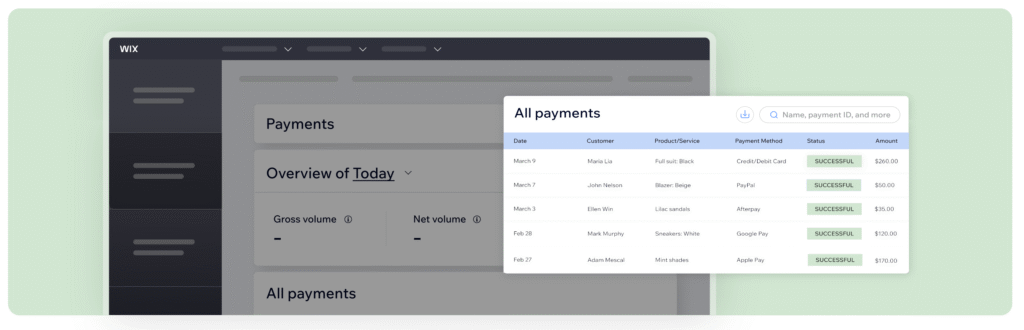

Integrated payment dashboard

Control all your business transactions from a single dashboard. Review payments, handle refunds and chargebacks, schedule payouts and more.

Built-in dispute tool

Quickly handle and respond to chargebacks. Our convenient tool allows you to monitor, accept and dispute chargebacks right from your dashboard.

Get financial resources to grow your business directly from Nex

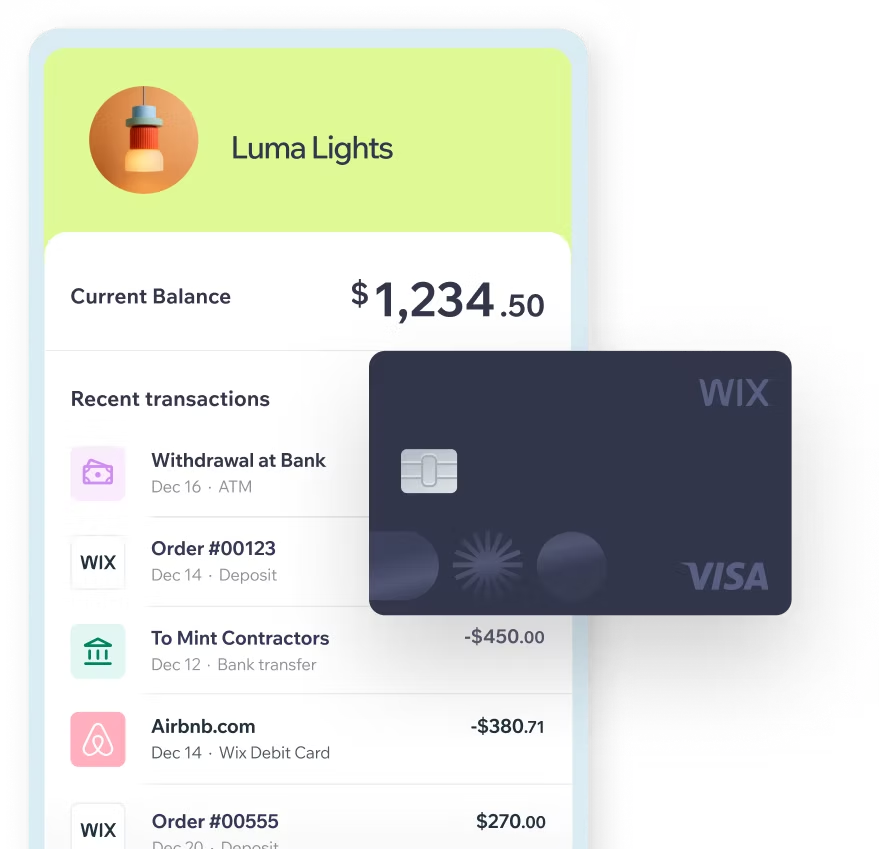

Get instant access to your

earnings with Nex Checking

Get paid faster and manage your business finances–all from your Nex Dashboard with instant payouts, real-time cashflow tracking, the ability to pay expenses with ACH transfers or your free Nex Visa® debit card, and enjoy it all with no monthly fees.

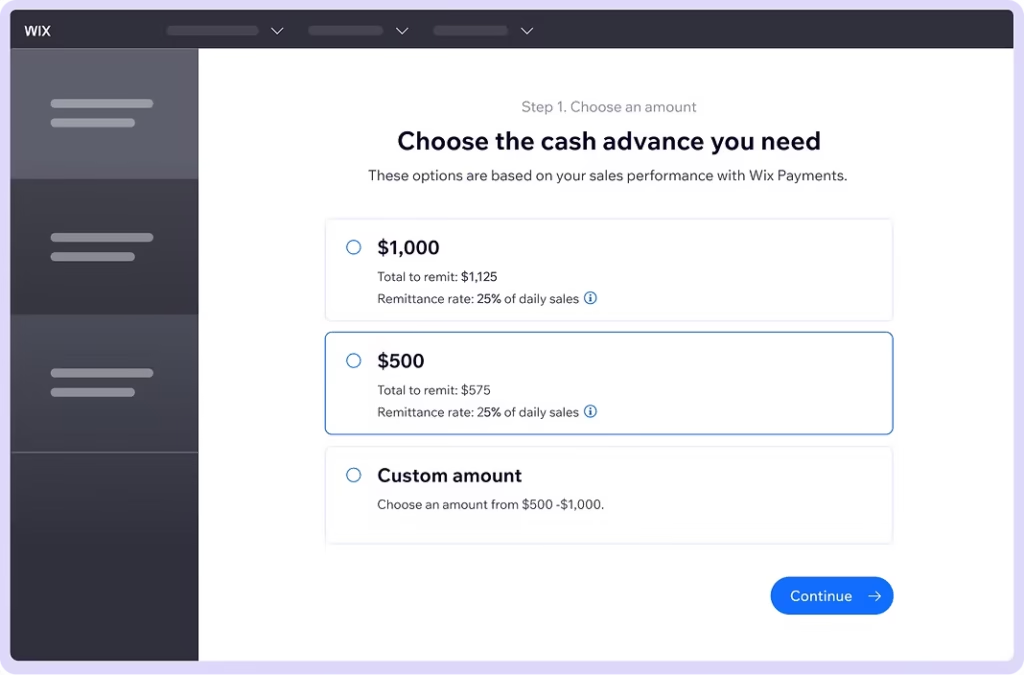

Get a cash advance to invest in growing your business

Get the cash you need to expand, stock up, or invest in marketing—no long application process, receive funds in 3-5 business days after approval, and you can remit automatically from a percentage of your sales with no interest or hidden fees.

Nex Capital & Nex Checking are currently being offered to eligible users in the U.S.

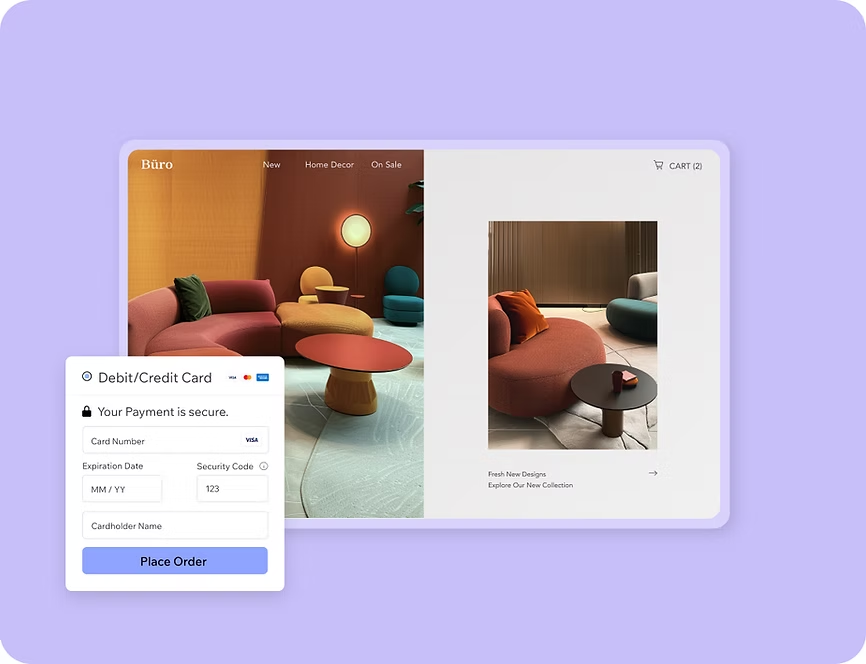

Protect customers with

secure transactions

PCI-compliant payment processing

Secure on-site and in-app checkout with HTTPS/TLS data encryption

AI-powered anti-fraud system and dedicated 24/7 risk team

3D Secure 2 authentication at checkout for EU card payments

Get expert tips on how to accept payments online

How to start an online store

How to accept secure online payment with Nex

Discount pricing strategies to help you sell

We’re here for you

Finding quick solutions

the Nex Help Center.

Contact Us

Get dedicated support by chat or schedule a call with a Customer Care Expert.

Accepting payments online FAQ

Why should I choose Nex payments?

Nex Payments is our own payment solution, allowing you to accept debit/credit cards, Apple Pay, Tap to Pay on iPhone and Android, Google Pay, and other popular payment methods from your customers. Our integrated provider lets you manage your payments where your orders and bookings are.

To learn more about Nex Payments, check out our article.

How do I connect Nex payments?

Follow these 3 easy steps to connect our own payment provider, Nex Payments. Follow our checklist to help walk you through the process. Then you can enable your desired payment methods without the hassle of integrating multiple providers.

Check that your location and business type are supported before connecting Wix Payments.

Fill in your business information to set up your Nex Payments account so you can get verified for payouts.

After your account is verified, you can receive payouts which will be sent directly to your bank account.

What payment methods are available with Nex payments?

You can accept debit and credit card payments from all major brands: Visa, Mastercard, American Express, Discover, Diners, CUP, JCB and Maestro. Depending on your location, you can also get paid via Apple Pay, Tap to Pay on iPhone, Google Pay, iDEAL, Pay Now by Klarna, Pix and Boleto.

Note: You can only use one provider for debit/credit card payments. To let your customers choose how they pay at checkout, we recommend adding alternative payment methods that work with Nex Payments, like PayPal or buy now, pay later solutions.

In which countries and currencies is Next Payments available?

Nex Payments is available in the following countries and currencies:

Austria (EUR)

Belgium (EUR)

Brazil (BRL)

Canada (CAD)

Finland (EUR)

Germany (EUR)

Ireland (EUR)

Italy (EUR)

Lithuania (EUR)

Netherlands (EUR)

Portugal (EUR)

Spain (EUR)

Switzerland (CHF)

United Kingdom (GBP)

United States (USD)

What types of businesses are supported by Nex Payments?

Can I use Nex Payments to accept payments in person?

Yes, you can. Nex Payments is built into Nex Point of Sale (POS), which automatically syncs your online and in-person payments, inventory, sales and more.

Please note, Nex POS is currently available to select U.S.-based and Canada-based Nex Merchants.

What are the processing fees for using Nex Payments?

Nex Payments charges a payment processing fee based on your payment method and transactions. With transparent pricing, you get one fixed fee for all credit cards. Nex doesn’t charge additional fees for processing refunds.

View Nex Payments’ processing fees here.

How do payouts work with Nex Payments?

What do I need to know about using Nex Payments?

Why should I accept multiple payment solutions?

The more payment options you provide on your site, the more customers you can encourage to complete transactions. Cater for a wide audience by offering multiple payment options like credit cards, Apple Pay, Google Pay, BNPL and more at your checkout.

How can I accept credit card payments online?

To accept card payments online, you need to connect a payment provider to your site. Once connected, you can easily take credit card payments at checkout.

By connecting Nex Payments, you can automatically accept credit and debit cards, Apple Pay, Google Pay and more. You can also seamlessly track all transactions right from your Nex dashboard.

How can I offer PayPal as a payment option to customers?

Nex now offers two ways to connect PayPal to your site–Nex Payments, or externally. By connecting PayPal with Nex Payments, a new PayPal account will be created for you – allowing you to then manage all sales (PayPal included) right in your Nex Dashboard. If you prefer you can still externally connect an existing PayPal account.

Learn More